Roth ira compound calculator

The Roth IRA allows workers to contribute to a tax-advantaged account let the money grow tax-free and never pay taxes again on withdrawals. A Roth IRA offers many benefits to retirement savers.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

. You can choose between a cash dividend you receive dividend payments in cash a preferred dividend you will be paid cash dividends. Because a standard 401k is funded with before-tax dollars you will need to pay taxes on those funds in order to move that money into an after-tax funded Roth IRA account. Credit Cards Insurance Taxes.

This means that there are tax consequences if you rollover a 401k to Roth IRA. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. A Roth IRA basis is the total amount of money youve contributed to your Roth IRA.

One of them is the type of dividend a company offers. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

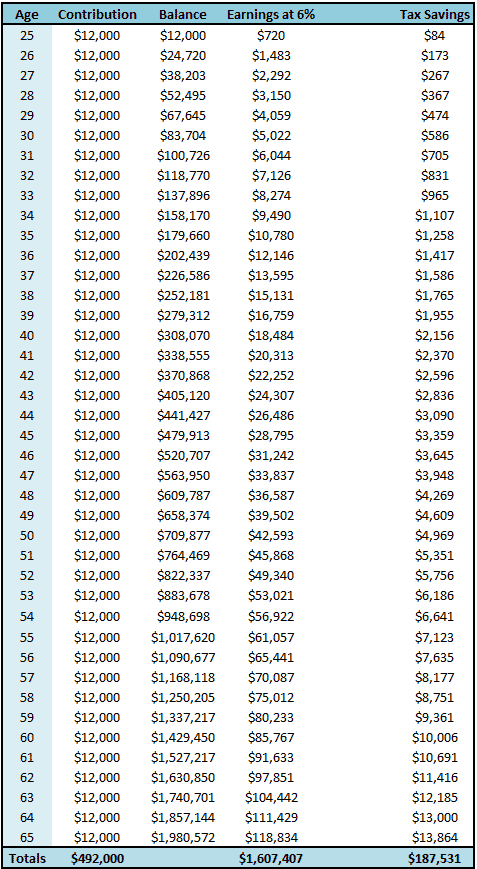

Almost all investment companies offer Roth IRA accounts. Keep in mind that when moving regular 401k or IRA money to a Roth the deferred income taxes are due at that point. Compounding is when your investment returns help you earn even greater returns in the future.

But in practice. Allows an employer typically a small business or self-employed individual to make retirement plan contributions into a traditional IRA established in the employees name. An Individual Retirement Account.

The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free. Roth IRA withdrawal rules allow you to take out up to 10000 earnings tax and penalty free as long as you use them for a first-time home purchase and you first contributed to a Roth account at. Still you must have taxable.

A Roth IRA can work as a backup account if youre saving for things beyond retirement. Is available to small. Roth Conversion Calculator Methodology General Context.

For a traditional IRA as of Jan. Contributions are made with after-tax funds and are not tax-deductible but earnings and withdrawals are tax-free. The Roth IRA is a powerful retirement account thats available to Americans even if they dont have an employer-sponsored retirement plan such as a 401k.

You would roll your 401k money to a traditional IRA and then convert to a Roth. While a Roth 401k has a 20500 contribution limit a Roth IRAs limit is 6000or 7000 if youre 50 or older. Contributions are made after taxes meaning your taxable income isnt reduced by the amount of your contributions when you file.

CD Calculator Compound Interest Calculator Savings Calculator Budget Calculator. Roth 401k With a Match. The letter of the law says it is OK to roll a 401k into a Roth IRA.

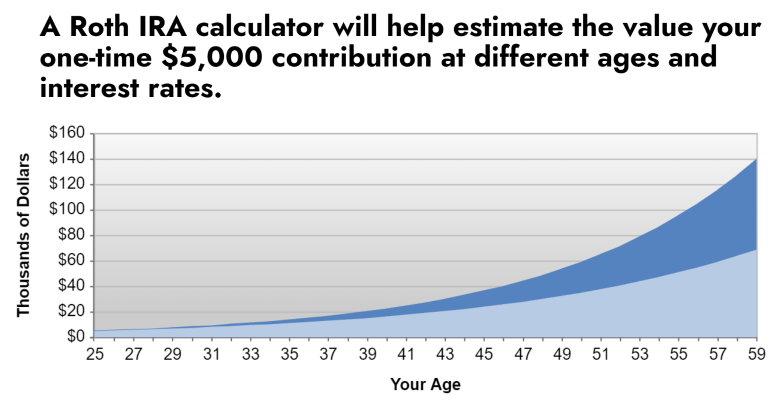

A Roth 401k and a Roth IRA sound similar and they are. To get a general idea of how your savings can compound in a Roth IRA check out this compound interest calculator. The ira calculator exactly as you see it above is 100 free for you to use.

1 2020 there is no maximum age at which you can make a contribution as long as you have sufficient taxable compensation to support the contribution amount. Our Assumptions For the best results you. If you have an existing traditional IRA the same company can probably open a Roth IRA for you.

4 A Roth 401k has no income limit. Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts Best Personal Loans Best Car Loans More. Roth IRA Calculator.

Its an important number to know for penalty-free withdrawals. The results will be display the after tax amount worth of your ROTH IRA at retirement. Plus a Roth IRA has an income limit on contributions 129000 for single filers and 204000 for married couples.

Decide Where to Open Your Roth IRA Account. The amount should be whatever can fit in the budget and can be increased over time Mike Hunsberger a chartered financial consultant and owner of Next Mission Financial Planning LLC told The Balance over email. Choose the Right Stocks.

The big one is the contribution limit. Theres no way to guarantee a good stock investment but there are certain factors you can consider while selecting a dividend stock for your Roth IRA. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional rollover SEP andor SIMPLE IRAs into a Roth IRA but it is intended solely for educational purposes it is not designed to provide tax advice and.

There is no upper age limit to make a contribution to a Roth IRA either before or after 2020.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/CompoundInterest-81619dfd810f42f19c41a257fe75c183.jpeg)

How Compound Interest Makes Roth Iras Worth It

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Roth Ira Contribution

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculators

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculators

Roth Ira For Millennials And Gen Z Wouch Maloney Cpas Business Advisors

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq